At 3.6 times earnings, the Bank of Georgia (LSE:BGEO) is among the cheapest companies on the FTSE 250. It also offers investors an impressive 6.8% dividend yield. That’s also one of the strongest on the FTSE 350.

So, is this a slam-dunk ‘buy’? Let’s take a closer look.

Valuation

The Bank of Georgia has some of the most attractive valuation metrics on the index. It’s far cheaper than many of its British peers including Lloyds and Barclays, which are widely considered cheap themselves.

But that’s not entirely surprising. After all, investors like to invest in companies they know, and this Tbilisi-based bank isn’t exactly front-page news in the UK. This, to some extent, explains why investors may be hesitant to buy Bank of Georgia shares.

However, earnings growth doesn’t look overly strong in the coming years. Here’s how earnings per share for 2022 compares with estimates going forward. I’ve also provided price-to-earnings ratios.

| 2022 | 2023 | 2024 | 2025 | |

| EPS (p) | 952 | 905 | 902 | 988 |

| P/E | 3.6 | 3.8 | 3.8 | 3.5 |

The lack of growth may appear slightly concerning despite the attractive P/E ratios. However, it’s contextual. The Bank of Georgia performed extraordinarily well in 2021 and 2022 amid economic tailwinds and higher net interest margins.

Cyclical stock

The Bank of Georgia is a cyclical stock — all commercial banks are. As such, it’s useful to look at the economic forecast for Georgia over the medium term.

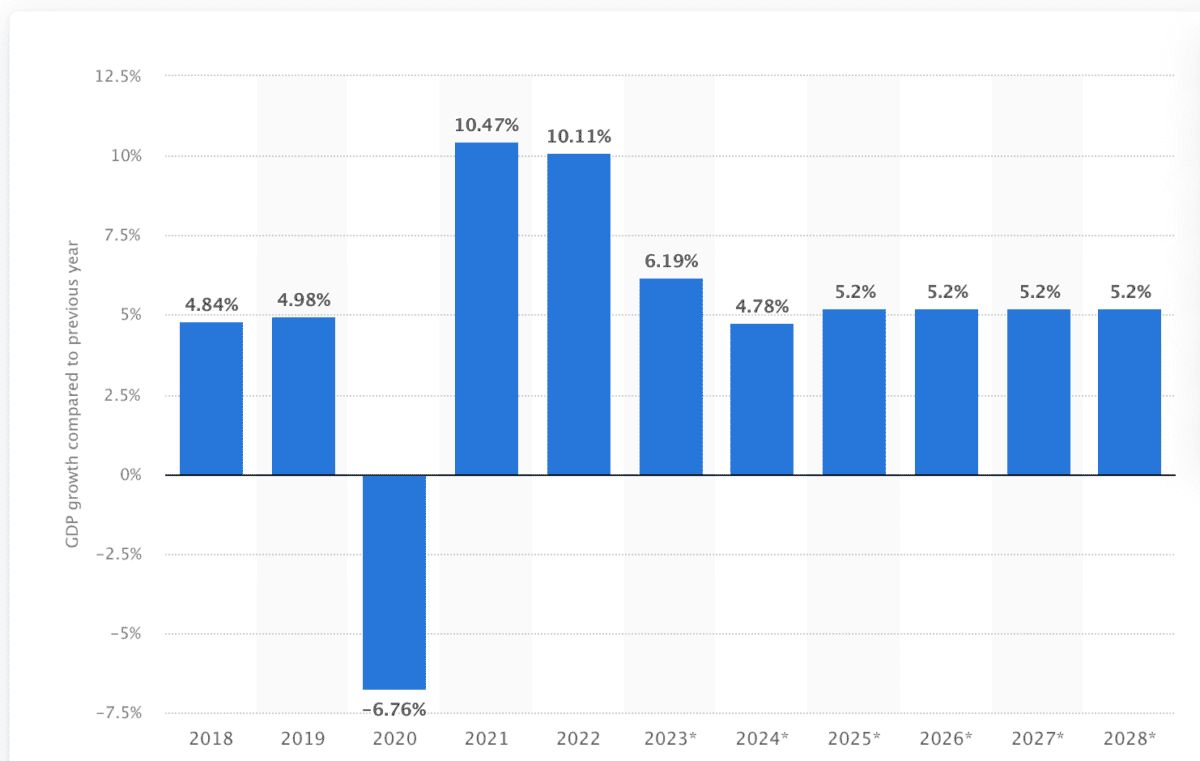

The below data highlights that, while the country’s economic growth will moderate from the exceptionally high rates seen in 2021 and 2022, it will remain among the fastest growing in Europe.

A robust economy benefits banks like the Bank of Georgia by fostering increased economic activity, higher consumer spending, and business expansion.

This leads to higher demand for financial services, including loans and investments, resulting in improved profitability and stability for the bank amid a flourishing economic environment.

Politics

The next parliamentary election in Georgia is scheduled for 2024. It is likely to be highly contested, as the country is deeply divided along political lines. The ruling Georgian Dream party is facing increasing pressure from the opposition, and has been accused of corruption as well as being too close to Moscow.

The election is being pitted as a battle between Georgian Dream chairman Bidzina Ivanishvili and Mikheil Saakashvili — the third president of Georgia who’s time in power was marred by forced nationalisation and a war with Russia.

Saakashvili’s return to Georgia has galvanised the opposition, and the ruling party has had to navigate several large-scale protests despite Ivanishvili’s party overseeing a decade of stability and growth.

As such, despite the attractive valuation data, I’m not buying shares in the Bank of Georgia at this time. Political unrest can create a lot of uncertainty about the future, which can make investors risk-averse.

While I like this stock, there could be better entry points in the coming year. I’m keeping my eyes peeled for that opportunity.